Go beyond live chat with Genesys Web Messaging

Continue the conversation 24/7 with our native asynchronous chat solution

Continue the conversation 24/7 with our native asynchronous chat solution

Answer questions and provide product information at the right moment — any time — with web messaging.

Seamlessly transition from a chatbot to an agent while retaining full context and visibility.

Share files, start a co-browse session or escalate to a phone call with just one click through our unified desktop.

Deliver empathetic experiences. Contextual business rules, like web activity and agent availability, power personalized messaging conversations.

Engage 24/7, across channels. Persistent messaging lets customers continue the conversation when they want without having to repeat themselves.

Serve website visitors more efficiently. Automate tasks with bots or route to agents with our easy-to-tailor conversation flows and proprietary knowledge base.

Configure and deploy in minutes. Make updates without waiting on IT support with our no-code/low-code implementation.

Make engagements more robust, intuitive and free of friction. Use quick replies, cards, carousels, emojis and file attachments to resolve engagements faster.

Meet your customers where they are. From web messaging and social media to SMS — agents can engage from a single, unified view of the customer.

Know your customers. Verify users when web messaging starts — no matter what browser they use — so agents can personalize the experience.

Provide high-touch assistance. Let agents see customers’ screens in real time as they navigate your website. Seamlessly elevate a web messaging conversation to co-browse.

People come to your website with a goal in mind, but sometimes they need help finishing the task. Studies show that web chat has the highest customer satisfaction level compared to other channels. And web messaging increases the odds of turning prospects into loyal customers.

Customer service teams see value — and embrace it, too. Administrators can easily deploy and customize messenger on any website with limited IT involvement. They’ll see improved efficiency and optimized staffing as team members handle multiple asynchronous conversations at the same time.

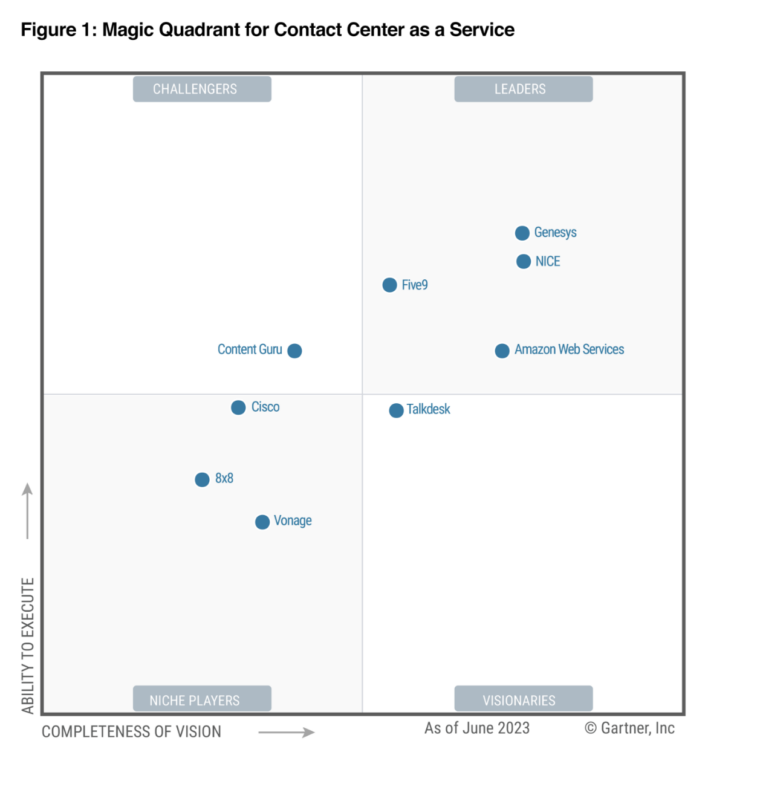

2023 Gartner® Magic Quadrant™ for Contact Center as a Service

Choose a solution in which asynchronous chat is just one of many ways to engage customers. It’s easy to navigate multiple conversations with an all-in-one, omnichannel, open platform. Reduce operational costs by automating routine, repetitive tasks. And empower agents with a unified workspace so they can quickly and easily transition from digital channels to web messaging without missing context. Give administrators the power to quickly build and customize business flow logic and integrate third-party applications.

Never miss an online opportunity. Trigger conversations at the right moment based on business rules, such as web behavior, user segmentation and customer profile. Unlike live chat solutions, web messaging gives your agents a view of the entire customer journey and conversation history without opening multiple tabs. They can also guide customers through more complex transactions. So if a customer needs guidance along the journey, your agents can assist with the option of a real-time co-browsing session.

Make it convenient to engage with your brand by giving customers the ability to pause and resume conversations — even across devices. If a customer decides to change pages, or close the messenger window, the conversation persists. This means you can be responsive at any time, even if the contact center is closed. Make experiences richer, more intuitive and free of friction for both the agent and the customer with the ability to send and receive multiple types of media content.

Whether you’re an enterprise organization or a small business, handle sensitive information with confidence. Genesys uses Hypertext Transfer Protocol Secure (HTTPS) and Transport Layer Security (TLS) to secure and support encrypted conversations, both prior and ongoing. Personally identifiable information or sensitive information is detected and hidden in real time via our co-browse masking functionality. And with authenticated web messaging, you can set it so only verified users can initiate agent sessions. Those users then can resume their web messaging conversations from any browser on any device, ensuring seamless and secure communication.

Within a three-week window time, we were able to move away from the old form and move into Web Messaging. It’s very early days, but the results are already showing in the calls that are coming through. We dropped 4% in rebooking queries into the customer center after one week.

— Ceri Davies, Manager, Customer Centre, Virgin Atlantic Airways

Web messaging, also known as asynchronous chat or asynchronous messaging, lets agents interact with customers to solve issues quickly. It uses asynchronous communication, meaning that customers can engage with your brand at any time, on any device. And if a customer pauses a conversation and resumes it later, the history remains for the customer and agent.

Synchronous live chat or web chat provides short-lived, standalone chats that require an agent to interact in real-time with the customer. It has a beginning and an end for each conversation, typically with immediate responses.

Note: Genesys Web Messaging is the name of our native 24/7 asynchronous chat solution.

In the past year, more consumers worldwide used a digital channel to interact with an organization than used the voice channel. In fact, some 72% of consumers used email for a CX interaction, while 68% called a contact center. The State of Customer Experience, Genesys 2023

Chatbots and messaging apps also continue to increase in popularity for CX interactions. This is a landmark moment.

Digital is no longer on the periphery as an alternative channel to voice. It’s now critical for organizations to have a connected voice and digital strategy that empowers customers across their journey. The State of Customer Experience, Genesys 2023

Native asynchronous functionality enables you to have 24/7 web presence through a messaging app.

For example, if a customer decides to change pages or close the native Genesys Messenger window, the conversation persists. Customers can engage with an agent after the contact center is closed or self-serve through a bot, search FAQs using the Messenger Knowledge Search App, or they can schedule a callback from the next-available live agent.

While companies might be looking to implement live chat software, they are actually in need of web messaging. Here’s four reasons why companies use web messaging over live chat:

Web messaging is convenient and accessible. Customers like being able to engage at their own pace and on their own schedules, without being tied to real-time conversations. And because web messaging is an “anywhere, anytime” solution, it’s ideal for 24/7 communication whenever it’s convenient for customers – and even across different devices, whether desktop or mobile web browsers.

In addition to other live chat tools, customers can enjoy richer, personalized and actionable conversations with brands through web messaging. Give your customers a more interactive digital experience using rich messaging and free them from the drudgery of typing long messages. And because you’ll have holistic customer profiles and customer journey data, you’ll know exactly who you’re talking to and why they’re reaching out. Customers don’t have to start their interaction from scratch every time they reach out.

Rich messaging is a great way to personalize and improve engagements.

Instead of having to type long messages, make your customer and agent experiences richer, more intuitive and free of friction with the ability to send and receive multiple types of media content. With web messaging, they’ll be able to use quick replies, cards, carousels, emojis and file attachments.

With holistic customer profiles and customer journey information, your agents will know exactly who they’re talking to and why. That same information can help agents know when it’s best to engage proactively.

By using our natively integrated Genesys Co-browse capability, agents can also gain a better understanding of customers’ needs by elevating the existing web messaging conversation to co-browse seamlessly – and still part of the original interaction. Agents will guide them through the most complex transactions – boosting the customer experience and improving conversion rates.

Screen sharing allows customers to share their entire desktop so agents can see everything happening on the customer’s screen. Co-browsing is limited to a specific browser. For example, if the customer decides to browse a different private website, the agent won’t see the new browsing session. This ensures a high level of user privacy.